ESG Services

In today's world, organizations face increasing scrutiny and pressure to demonstrate their commitment to sustainable and ethical practices. ESG has emerged as a powerful tool for businesses to communicate their environmental impact, social responsibility, and governance practices to stakeholders, including investors, employees, customers, and communities.

At Trendsetters Skill Assessors (TSA), we understand that ESG goes beyond compliance; it is an opportunity for companies to enhance their brand reputation, attract investments, and drive long-term value. Our comprehensive suite of ESG services enables organizations to identify, measure, and communicate their sustainability performance effectively.

Why ESG?

- Regulatory Compliance – ESG reporting has been made mandatory by SEBI for the top 1000 listed companies, and every year SEBI is increasing the scope and boundary under BRSR to cover a larger pool of companies.

- Investor Funds – Institutional investors are now seeking ESG reports before making an investment decision.

- Client Requirement – Companies are increasingly pushing their tier-1 suppliers to adopt ESG practices and continuously improve their ESG performance.

- Risk Management – Companies are able to mitigate risks posed from climate change, regulations, supply chain through integrating ESG into their business.

1. ESG Assessment & Due-diligence

-

Our team at TSA develops a tailored-made assessment centred around a business’s material topics covering environmental impact, social responsibility and governance practices.

- Environmental impact covers topics such as carbon emissions, water usage, waste production, energy consumption, material usage etc.

- Social responsibility includes topics such as labour practices, gender diversity, community relationship, product safety etc.

- Governance practices encompass activities such as grievance redressal system, board diversity, regulatory requirements etc.

2. ESG Reporting & Disclosures

-

Our team consists of trained and certified GRI and ESG Reporting professionals who help your company in calculating and then subsequently communicating your impact across Environmental, Social and Governance pillars. We ensure transparency and consistency in the reporting framework facilitating accountability and trust amongst stakeholders.

- Global Reporting Framework (GRI)

- Climate Disclosures Standard Board (CDSB)

- Sustainability Accounting Standards Board (SASB)

- Task Force on Climate-Related Disclosures (TCFD)

- Sustainable Development Goals (SDGs)

- Climate Disclosure Project (CDP)

- Integrated Reporting (IR)

Publishing an ESG Report can give you an edge in raising funds and attracting institutional investors to invest in your company.

The global reporting frameworks integrated into the ESG reporting by us are,

Our Comprehensive ESG Services

Stakeholder Engagement

Effective stakeholder engagement is crucial for successful ESG initiatives. We guide businesses in developing robust stakeholder engagement strategies, fostering open dialogue, and building long-term relationships with investors, employees, customers, NGOs, and local communities.

Materiality Assessment

We conduct materiality assessments to identify the most critical ESG issues for your organization. This process helps prioritize initiatives, allocate resources efficiently, and focus on areas that have the greatest impact on sustainability performance and stakeholder value.

ESG Data Collection and Analysis

We help organizations gather relevant ESG data through our comprehensive data collection tools and methodologies. Our team of experts employs advanced analytics to analyze the data and identify key insights, enabling businesses to make informed decisions and set meaningful sustainability goals.

3. ESG Strategy & Roadmap

-

Our team builds a comprehensive roadmap centred around your business goals to facilitate maximum risk management and seize the opportunities presented by Climate Change. We develop robust ESG strategies tailored to your unique needs and industry dynamics. Our experienced consultants provide guidance on integrating ESG considerations into corporate governance, risk management, and overall business strategies.

TSA gives an elaborate roadmap with short-term, medium-term and long-term targets and metrics across Environmental, Social and Governance factors to enable your company in mitigating risk and adapting to the changing landscape.

4. BRSR

-

TSA provides a complete ecosystem and support for your BRSR needs. Our team of experts conducts a 360-degree assessment to identify and highlight potential risks and opportunities which can arise with BRSR reporting.

Business Responsibility and Sustainability Reporting (BRSR)

The evolving global landscape of Environmental, Social, and Governance (ESG) reporting has prompted Indian business leaders to recognize the importance of aligning corporate purpose with broader stakeholder concerns. India has demonstrated commitment to ESG initiatives through regulatory frameworks like the Business Responsibility and Sustainability Reporting (BRSR) introduced by SEBI in 2021.

2012

Business Responsibilit Reporting (BRR) for top 100 companies.

2015

BRR extended to top 500 listed companies.

2019

BRR extended to top 1000 listed companies.

2021

Business Responsibility and Sustainability Reporting (BRSR) released for top 1000 listed companies.

2023

BRSR Core for assurance by Top 150 listed companies in FY24.

Subset of BRSR having mandatory Discloser.

Background

Prior to the introduction of the BRSR (Business Responsibility and Sustainability Reporting) framework in India, the country had already ventured into ESG (Environmental, Social, and Governance) regulatory structures and disclosures. In 2012, SEBI (Securities and Exchange Board of India) initiated the necessity for ESG reporting. This took the form of the Business Responsibility Report (BRR), which was made obligatory for the top 100 companies listed on the Indian stock exchange based on market capitalization. Over time, the BRR has transformed into the BRSR, creating a comprehensive framework for ESG reporting. Notably, this evolution has effectively addressed deficiencies in terms of both the accuracy and depth of reporting.

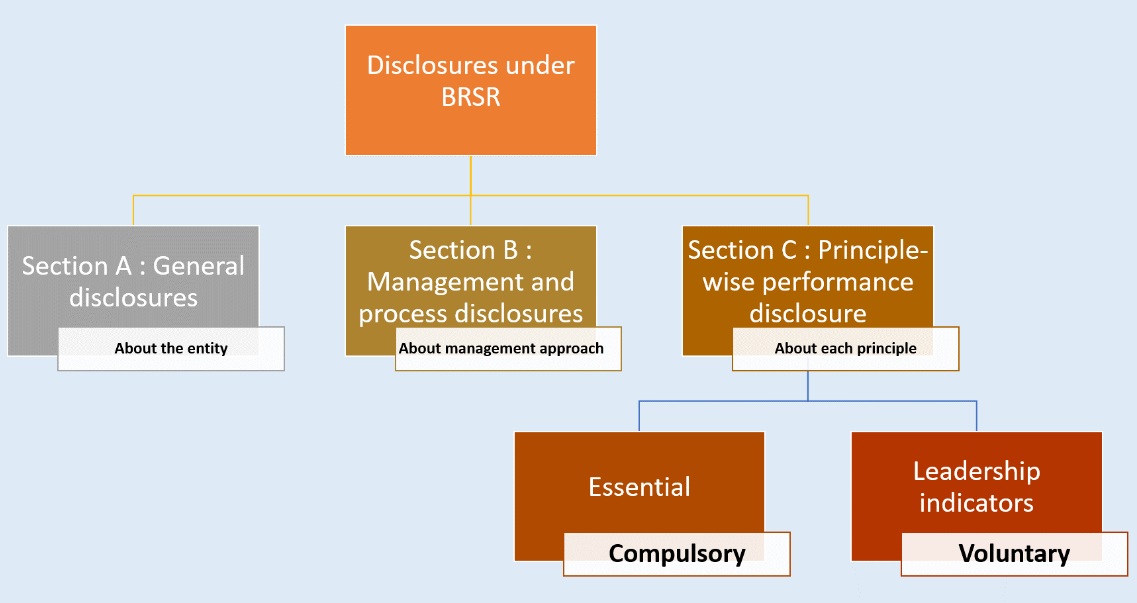

Components of BRSR

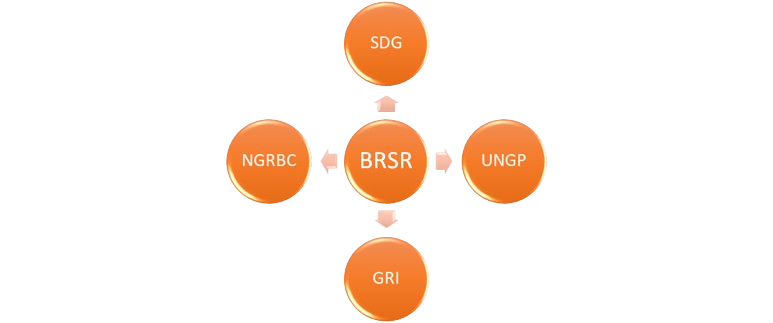

The BRSR framework is founded upon nine principles that are promoted in the National Guidelines for Responsible Business Conduct (NGRBC), which have been set forth by the Ministry of Corporate Affairs (MCA).

The BRSR format, featuring general, management, and principle-wise disclosures, provides a standardized platform for ESG reporting among listed companies, bridging financial and non-financial aspects transparently. Through mandatory compliance, BRSR facilitates effective communication of sustainability challenges, goals, achievements, and potential risks, positioning it as a pivotal step in advancing ESG reporting.

The Securities and Exchange Board of India (SEBI) requires the top 1000 listed entities in India by market capitalization to make filings as per the Business Responsibility and Sustainability Report from FY 2023. It should be included in their Annual Reports.

Why us?

- a) Certified Professionals

- b) Tailored Services

- c) Alignment with Business Goals

- d) Comprehensive Assessment & Reporting

5. Assurance Services

-

Our certified assurance providers help in validation and verification of your ESG claims making your report more reliable, thereby increasing transparency amongst the stakeholders. Our team of technical experts has experience in both limited and reasonable assurance.

- ESG Report

- GHG Report

- BRSR Core

We provide assurance for the following reports,