Driving Business Success through Sustainability

In today's world, organizations face increasing scrutiny and pressure to demonstrate their commitment to sustainable and ethical practices. ESG reporting has emerged as a powerful tool for businesses to communicate their environmental impact, social responsibility, and governance practices to stakeholders, including investors, employees, customers, and communities.

At Trendsetters Skill Assessors (TSA), we understand that ESG reporting goes beyond compliance; it is an opportunity for companies to enhance their brand reputation, attract investments, and drive long-term value. Our comprehensive suite of ESG services enables organizations to identify, measure, and communicate their sustainability performance effectively.

Our Comprehensive ESG Services

ESG Strategy and Consulting

We partner with businesses to develop robust ESG strategies tailored to their unique needs and industry dynamics. Our experienced consultants provide guidance on integrating ESG considerations into corporate governance, risk management, and overall business strategies.

Stakeholder Engagement

Effective stakeholder engagement is crucial for successful ESG initiatives. We guide businesses in developing robust stakeholder engagement strategies, fostering open dialogue, and building long-term relationships with investors, employees, customers, NGOs, and local communities.

ESG Data Collection and Analysis

We help organizations gather relevant ESG data through our comprehensive data collection tools and methodologies. Our team of experts employs advanced analytics to analyze the data and identify key insights, enabling businesses to make informed decisions and set meaningful sustainability goals.

Materiality Assessment

We conduct materiality assessments to identify the most critical ESG issues for your organization. This process helps prioritize initiatives, allocate resources efficiently, and focus on areas that have the greatest impact on sustainability performance and stakeholder value.

ESG Reporting Framework Development

We assist in developing customized ESG reporting frameworks aligned with international standards such as GRI (Global Reporting Initiative), SASB (Sustainability Accounting Standards Board), and TCFD (Task Force on Climate-related Financial Disclosures). Our frameworks ensure transparency and consistency in ESG reporting, facilitating effective communication with stakeholders.

Business Responsibility and Sustainability Reporting (BRSR)

The evolving global landscape of Environmental, Social, and Governance (ESG) reporting has prompted Indian business leaders to recognize the importance of aligning corporate purpose with broader stakeholder concerns. India has demonstrated commitment to ESG initiatives through regulatory frameworks like the Business Responsibility and Sustainability Reporting (BRSR) introduced by SEBI in 2021.

2012

Business Responsibilit Reporting (BRR) for top 100 companies.

2015

BRR extended to top 500 listed companies.

2019

BRR extended to top 1000 listed companies.

2021

Business Responsibility and Sustainability Reporting (BRSR) released for top 1000 listed companies.

2023

BRSR Core for assurance by Top 150 listed companies in FY24.

Subset of BRSR having mandatory Discloser.

Background

Prior to the introduction of the BRSR (Business Responsibility and Sustainability Reporting) framework in India, the country had already ventured into ESG (Environmental, Social, and Governance) regulatory structures and disclosures. In 2012, SEBI (Securities and Exchange Board of India) initiated the necessity for ESG reporting. This took the form of the Business Responsibility Report (BRR), which was made obligatory for the top 100 companies listed on the Indian stock exchange based on market capitalization. Over time, the BRR has transformed into the BRSR, creating a comprehensive framework for ESG reporting. Notably, this evolution has effectively addressed deficiencies in terms of both the accuracy and depth of reporting.

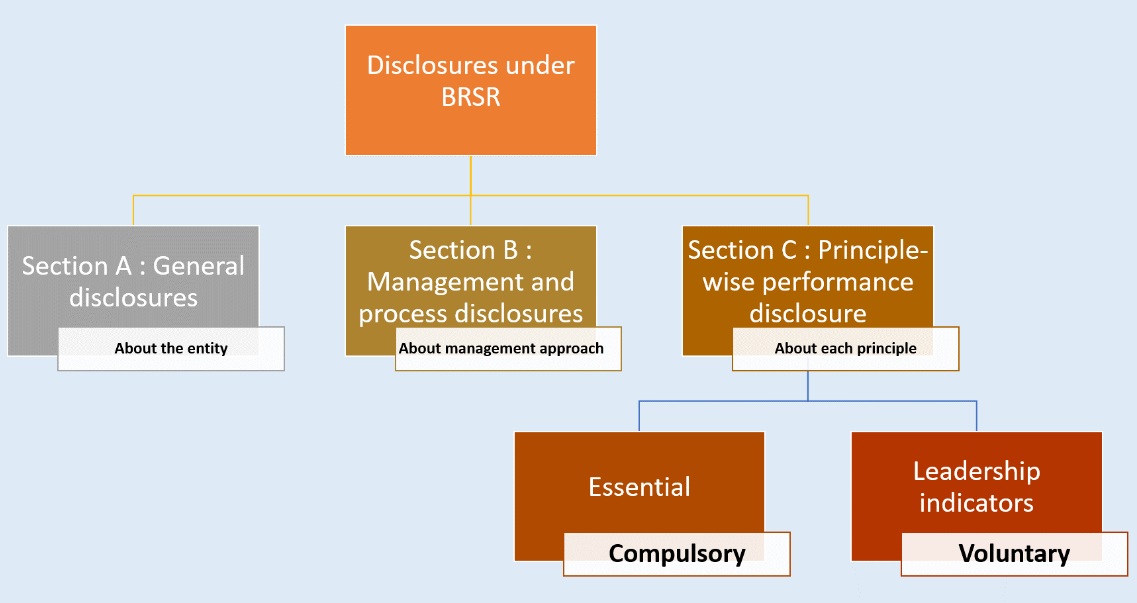

Components of BRSR

The BRSR framework is founded upon nine principles that are promoted in the National Guidelines for Responsible Business Conduct (NGRBC), which have been set forth by the Ministry of Corporate Affairs (MCA).

The BRSR format, featuring general, management, and principle-wise disclosures, provides a standardized platform for ESG reporting among listed companies, bridging financial and non-financial aspects transparently. Through mandatory compliance, BRSR facilitates effective communication of sustainability challenges, goals, achievements, and potential risks, positioning it as a pivotal step in advancing ESG reporting.

The Securities and Exchange Board of India (SEBI) requires the top 1000 listed entities in India by market capitalization to make filings as per the Business Responsibility and Sustainability Report from FY 2023. It should be included in their Annual Reports.

BRSR Core Assurance

In July 2023, upon the recommendations of the ESG Advisory Committee and after conducting public consultations, the SEBI added new ESG metrics for mandatory disclosure under ‘BRSR Core’ for certain listed companies in India. The Board has decided to introduce:

- 1. BRSR Core for assurance by listed entities.

- 2. Disclosure and assurance for the value chain of listed entities, as per the BRSR core.

While SEBI has stipulated a timeline for mandatory compliance under the BRSR Core, as of FY 2023, all of the top 1000 listed companies by market cap in India must file their BRSR Report.

The BRSR Core represents a subset of the comprehensive BRSR. With a focus on the Indian / emerging market context, additional KPIs have been identified for assurance. It includes a specific set of key performance indicators (KPIs) / metrics across nine ESG attributes such as:

- 1. GHG footprint

- 2. Water footprint

- 3. Energy footprint

- 4. Embracing circularity

- 5. Employee wellbeing and safety

- 6. Gender diversity in business

- 7. Inclusive development

- 8. Fairness in engaging with customers and suppliers

- 9. Open-ness of business

Following is the timeline proposed by SEBI for enforcement of mandatory reasonable assurance from FY 2023-24.

FY 2023-24: Reasonable assurance on BRSR core for top 150 listed entities

FY 2024-25: Reasonable assurance on BRSR core for top 250 listed entities

FY 2025-26: Reasonable assurance on BRSR core for top 500 listed entities

FY 2026-27: Reasonable assurance on BRSR core for top 1000 listed entities

How we can help you?

TSA provides a complete ecosystem and support for your BRSR needs. Our team of experts conducts a 360-degree assessment to identify and highlight potential risks and opportunities which can arise with BRSR reporting. Our team of technical experts has experience in both advisory and assurance services. The team has expertise in sustainability and ESG reporting as per GRI, BRSR, Integrated reporting, SASB frameworks; ESG Strategy development, GHG Accounting and provision of limited & reasonable assurance.

We align Purpose with Profitability

Doing good for your business and the world goes beyond just checking boxes. It's about making a real impact that benefits both. We believe in creating lasting results that drive value and growth for your business while also improving our environment and societies.

Our dedicated team of experts are here to collaborate with you. They bring their real-world experience and a strong commitment to making a difference. Together, we can turn ideas into action, challenge the status quo, and find innovative solutions. By combining the power of people and technology, we aim to create a transparent and brighter future for generations to come.